China Total Meat Imports Forecast Higher in 2023

Maim Photo: Free Malaysia Today

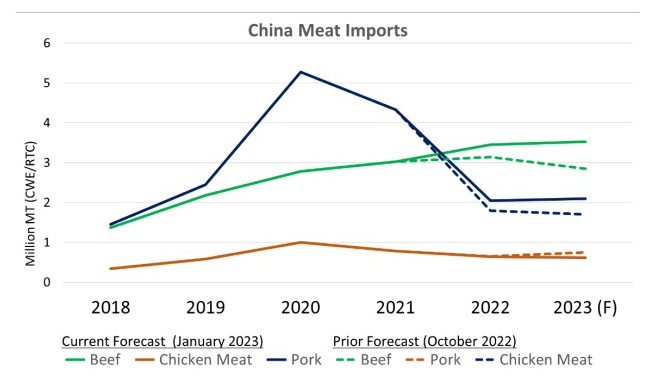

Despite the challenges of the current wave of COVID-19 infections in China, the import forecasts of beef and pork in 2023 are revised up and are now forecast higher year-on-year. However, chicken meat imports are forecast marginally lower.

The upward revisions for China red meat import forecasts are partially derived from higher estimates for 2022 as fourth quarter shipments were stronger than expected. For 2023, projected economic recovery as well as the anticipated revival of the hotel, restaurant, and institutional (HRI) sector support expanding consumption and red meat imports. Despite an upward revision for China pork production in 2023 from the October forecast, domestic supplies are virtually unchanged year on year and are unlikely to fully meet rebounding consumption.

Beef imports are expected to grow in 2023, but the pace of shipments will slow as importers have product in cold storage that needs to enter the market before they will invest in additional purchases.

China chicken meat imports are revised lower to pre-pandemic levels. Lower pork prices are expected to lower consumer demand for chicken meat. However, chicken meat imports account for only about 4 percent of consumption

Beef

Global beef production for 2023 is virtually unchanged from the October forecast at 59.2 million tons. Global beef carcass prices have eased entering 2023 — except for the United States. Nevertheless, carcass prices among major exporters are still relatively high when compared to pre-pandemic levels, suggesting limited supplies and firm demand from key markets.

Global beef exports for 2023 are virtually unchanged from the October forecast at 12.2 million tons. China imports are raised given the lifting of COVID-19 restrictions which will strengthen HRI demand. Australia and Brazil are expected to gain market share due to lower exportable supplies in the United States, Uruguay, and Argentina. U.S. imports are also raised as lower U.S beef production supports additional imports from Brazil and Australia.

Pork

Global pork production for 2023 is revised up 3 percent from the October forecast to 114.1 million tons on higher output in China. Pork demand is expected to strengthen in China due to recently lifted COVID-19 restrictions. Production forecasts remain largely unchanged for other countries.

Global pork exports for 2023 are forecast 2 percent higher from the October forecast to 10.7 million tons as EU, Brazil, and U.S. exports are up on stronger than anticipated demand from key Asia markets. Upward revisions in China and Philippines imports will more than offset a decline in the United States. Philippines imports are forecast higher as reduced import tariffs for pork are extended through 2023. African swine fever continues to stifle Philippines production, boosting demand for imports.

Chicken Meat

Global chicken meat production for 2023 is virtually unchanged from the October forecast at 102.9 million tons as upward revisions for United Kingdom, Thailand, and Mexico offset a decrease for Brazil. United Kingdom production continues its expansion on strong demand despite labor issues, higher input costs, and recent outbreaks of highly pathogenic avian influenza (HPAI). Lower production costs for feed and genetics will spur Thailand production. Brazil is revised lower on weaker foreign demand, particularly from China.

Global chicken meat exports for 2023 are revised 1 percent lower from the October forecast to 14.0 million tons. Weaker China, EU, South Africa, and UK demand will primarily impact Brazil, the world’s leading exporter. While Brazil shipments are forecast lower compared to the October forecast, volumes are still expected to reach a historical level. Competitive pricing, the absence of HPAI, and diverse product offerings will enable Brazil’s reduction in shipments to China to be largely offset by other markets.

(USDA)